Bank better with a U.S. Bank Smartly ® Checking account that keeps your money safe while earning you interest. 1 Then, easily manage your money with our top-rated mobile app. Apply in under 5 minutes.

You may also qualify if you’re a member any one of our special customer groups including youth age13 to 24, seniors age 65 and greater, military personnel and more.

Earn these extra perks when you join Smart Rewards® for free

Sign up for Smart Rewards ® with your Bank Smartly ® Checking account and be eligible for exclusive benefits like:

Plus, get even more perks as you automatically level up in the Smart Rewards® program by combining balances from eligible accounts.

Overdrafts sometimes happen. Here are 3 ways we’ve got your back.

Overdrawn $50 or less? Receive $50 overdrawn available balance threshold and overdraft protection that waives the Overdraft Protection Transfer Fee when you link up an eligible account to your checking account. 7

Overdrawn more than $50? Our Overdraft Fee Forgiven 8 program is the backup to your backup plan. Get fees waived when you make a qualifying deposit(s) before 11pm ET on the day you are charged the fee.

Set up account alerts to notify you about low balances so you can avoid overdraft penalty fees.

Switching your direct deposit is quick and hassle-free. Here’s why you’ll love it.

Enroll in just 3 simple steps. All you need is your payroll or employee login.

Your update is seamless, secure and verified in real time.

Once enrolled, you can use your paycheck the same day it’s deposited.

Concerned about your cash? We’re an FDIC-insured bank. Your money’s safe.

You’re covered with the standard deposit insurance coverage limit is $250,000 per depositor, per ownership category, per FDIC-insured bank

You’re protected with the industry’s strongest available encryption.

Zero fraud liability for unauthorized transactions. 9

Set up account alerts to notify you about any unusual activity.

Raise financially smart kids with complimentary access to Greenlight. Here’s how.

Complimentary access to Greenlight 10 lets you:

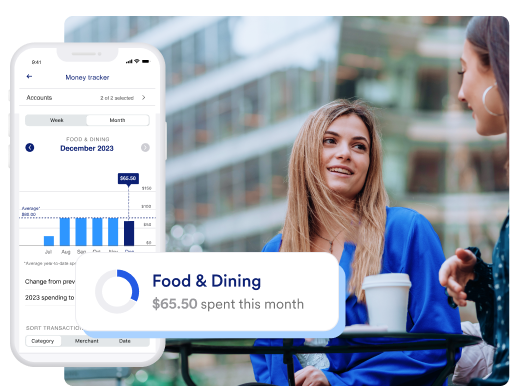

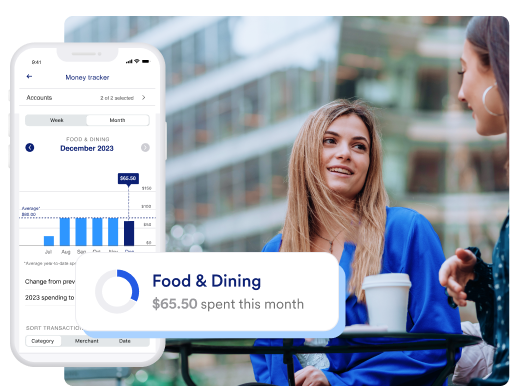

Build a better budget with our automated financial tools.

Use the U.S. Bank Mobile App to track your spending categories and set up alerts to help you stay on track.

Get market insights tailored to your needs so you can make informed decisions about spending and investing.

Use our goal planner to help you estimate how much you’ll need for your next passion project, special trip, down payment on a home, or new addition to the family.

Manage your accounts, even ones from other financial institutions.

Quickly link all your accounts, even ones at other banks, using our mobile app. Then, use our budgeting tool and personalized insights to get a clear picture of your finances.

Mobile check deposits

Automated bill pay

Overdraft Fee Forgiven 8 and overdraft protection

Zelle ® instant transfers 11

Account alerts and reminders

Bank Smartly ® Checking

Apply in under 5 minutes.

Easily pay your bills, set notifications or reach a representative. Plus, feel safe knowing that you're always connected to your money and, in case you missed it, it's FDIC insured.

It's easy to use.

Once you log in, tap the mic to talk. U.S. Bank Smart Assistant® is ready when you are.

For your eyes only

We offer the industry's strongest available encryption and zero fraud liability. 9

Saves time on everyday banking

Smart Assistant helps you skip steps to complete common tasks quickly.

¿Hablas español? Nosotros también.

Operaciones bancarias con confianza en el idioma de tu preferencia.

Bank Smartly ® Checking lets you manage your cash flow and gives you access to automated tools to help you spend and save wisely. Get started with an initial deposit of $25.

Apply online in less than 5 minutes.

Fund your account using an internal or external transfer. You can also add money using your credit, debit or prepaid card.

Securely switch your direct deposit online in minutes.

How old do I have to be to open my own Bank Smartly® Checking account?

You can apply for an individual bank account if you’re 18 years or older and a legal U.S. resident. You’ll need to provide your Social Security number and a valid, government-issued photo ID. Not quite 18?

The U.S. Bank Smartly ® Checking account offers special benefits for Youth ages 13 through 17 when you open an account with an adult.

What are the differences between checking and savings accounts?

A regular checking account is typically used for day-to-day spending and paying your bills. You can easily access your money with a debit card, ATM or by writing a check (if you have a traditional checking account with checks). Although Bank Smartly® Checking is an interest-bearing checking account, savings accounts are meant to help you grow your money or set aside funds for a big purchase. It’s often beneficial to have both as part of your financial plan.

Can Overdraft Paid Fees be waived?

Yes. Our Overdraft Fee Forgiven 8 program is your backup to your backup plan when your available balance is overdrawn $50.01 or more. Get your Overdraft Paid fee waived when you make a qualifying deposit(s) before 11 p.m. ET on the day you are charged the fee.

Where do I find answers to other checking account questions?

Get answers to other frequently asked questions and learn about account services, features and benefits on our Checking Customer Resources page.

Can I open a checking account online?

Yes, you can open a checking account online.

Are there special military benefits for members of the U.S. Armed Forces?

As a current or former member of the United States Armed Forces, open a Bank Smartly ® Checking account and you'll automatically be enrolled in the Smart Rewards ® Plus tier, 14 at a minimum, regardless of your account balance.

How do I open a checking account for my teen or college student?

Bank Smartly ® Checking offer special benefits to Young Adults ages 18 through 24 and Youth ages 13 through 17. Young Adults may apply for an account individually or jointly. Youth must apply jointly with an adult.

Does U.S. Bank have special perks for seniors (age 65 or greater)?

Yes, as a senior (age 65 or greater), you’re automatically eligible for additional services and rewards tailored to meet your needs.

Are there additional benefits available with my checking account?

Yes, if you are a member of one of our eligible customer groups, you automatically qualify for additional services and rewards tailored to meet your needs.

Is it easy to switch my direct deposit?

Yes. With our automated setup, enrolling in direct deposit is easy:

Your direct deposit update is seamless, secure and verified in real time.

If you’re one of the millions of Americans using a checking account, you should know how to keep it balanced.

Your beliefs about spending and saving money can boost or block your financial success. Here’s how to make your money mindset an asset.

When it comes to financial wellness and saving for the future, at U.S. Bank, you have options.

Money Market Accounts

Easily access your money and get higher returns based on your balance tier.

Safe Debit Account 15

Enjoy the perks of a checking account without all the checks.

Certificates of deposit (CDs)

Lock in great rates that outshine traditional savings.

Start of disclosure content Return to content, FootnoteVariable rate account – Interest rates are determined at the bank’s discretion and may change at any time. Speak to a banker for current deposit rates, disclosures on rates, compounding and crediting and other balance information.

Members of the military (requires self disclosure) and clients ages 24 and under and those 65 and over pay no monthly maintenance fee. All others can have it waived by meeting any one of the following criteria: Have combined monthly direct deposits totaling $1,000 or more; or keep a minimum average account balance of $1,500 or more; or presence of an eligible personal U.S. Bank credit card; or qualify for one of the four Smart Rewards ® tiers (Primary, Plus, Premium or Pinnacle). The average account balance is calculated by adding the balance at the end of each calendar day in the statement period and dividing that sum by the total number of calendar days within the statement period. Other fees may apply. Please refer to the Consumer Pricing Information (PDF) disclosure for more details.

The average account balance is calculated by adding the balance at the end of each calendar day in the statement period and dividing that sum by the total number of calendar days within the statement period.

Qualifying accounts include personal U.S. Bank open and activated credit cards in good standing and you are an account owner. This benefit may take up to 5 business days to be applied after credit card activation. Credit products are subject to eligibility requirements and credit approval and may be subject to additional charges such as annual fees. No limitation on Bank Smartly ® checking accounts with this benefit.

Exclusive Smart Rewards cash back deals are available to U.S. Bank personal credit cardmembers whose accounts are open and in good standing who: (1) have a U.S. Bank Smartly ® Checking account; (2) are enrolled in the U.S. Bank Smart Rewards program; and (3) qualify for the Primary tier of the program or higher. Cardmembers who have both a personal credit card account and a business credit or charge card account with U.S. Bank are not eligible for these offers. Smart Rewards cash back deals appear in online banking and the U.S. Bank mobile app and will change approximately every 45 days. Following enrollment in U.S. Bank Smart Rewards program, offers will be made available to eligible cardmembers within 4-6 weeks. To access and activate the cash back deals, cardmembers must log in to online banking or the mobile app and select the Smart Rewards cash back deals to activate them. Once the deal or deals are activated, shop online or in store at offer-activated stores using your enrolled U.S. Bank personal credit card at checkout. Terms and conditions applicable to each offer are provided with the offer. Cash back is automatically credited within 5-7 business days to the card or account used to complete the deal.

When changing checking account types, corresponding Non-U.S. Bank ATM transaction fee waivers will become available on the first day of the next statement cycle. ATM transaction fee waivers are only applicable for your U.S. Bank Smartly ® Checking accounts.

If you have linked eligible accounts and the negative Available Balance in your checking account is $5.01 or more, the advance amount will transfer in multiples of $50. If, however, the negative Available Balance is $5 or less, the amount advanced will be $5. The Overdraft Protection Transfer Fee is waived if the negative Available Balance in your checking account is $50 or less. Note: If you have Overdraft Protection and your account becomes overdrawn, Overdraft Protection funds will be accessed before the account is eligible for U.S. Bank Overdraft Fee Forgiven.

Refer to Your Deposit Account Agreement (PDF) section titled Overdraft Protection Plans for additional information.

Consumer checking accounts (excluding Safe Debit accounts) assessed an Overdraft Paid Fee may qualify for a fee waiver. The Overdraft Fee Forgiven period starts the first day your Available Balance becomes negative and you were charged an Overdraft Paid Fee(s). U.S. Bank will review your account at the end of the Overdraft Fee Forgiven period (11 p.m. ET) and if your Available Balance (excluding the Overdraft Paid Fees and including immediate and same day deposits), is at least $0 we will waive Overdraft Paid Fee(s) charged. Deposits that generally will qualify for Overdraft Fee Forgiven include: ACH and electronic deposits, cash deposits, wire transfers, ATM deposits at U.S. Bank ATMs, check deposits in branch and internal transfers from another U.S. Bank account. Deposits that generally will not qualify for Overdraft Fee Forgiven include: Mobile check deposit, extended hold placed on a deposit and deposits into new accounts opened less than 30 days where funds are generally made available the fifth business day after the day of your deposit. Refer to the Determining the Availability of a Deposit – All Accounts section of Your Deposit Account Agreement (PDF) for full funds availability details.

Zero fraud liability – U.S. Bank provides zero fraud liability for unauthorized transactions. Cardholder must notify U.S. Bank promptly of any unauthorized use. Certain conditions and limitations may apply. See the Electronic Fund Transfers section in Your Deposit Account Agreement (PDF) for details.

U.S. Bank customers are eligible to receive the Greenlight Select plan complimentary when an eligible U.S. Bank checking account (excludes Safe Debit and Electronic Transfer accounts) is added as a funding source. You are required to be an authorized transactor on the U.S. Bank account, be at least 18 years of age, and be enrolled in online banking. Your U.S. Bank checking account(s) must be the preferred funding source for your Greenlight account for the entirety of the partnership. If your U.S. Bank checking account(s) cease to be the preferred funding source for your Greenlight account or you add a funding source that is not an eligible U.S. Bank checking account, you may be charged a monthly fee by Greenlight. In-app upgrades will result in additional fees. Subject to Greenlight identity verification. See greenlight.com/terms for additional information. Offer subject to change.

To send and receive money in minutes with Zelle®, you must have an eligible United States bank account and have a United States mobile number registered in your online and mobile banking profile for at least three calendar days. Transactions between enrolled consumers typically occur in minutes.

U.S. Bank named one of the “World’s Most Ethical Companies®” Ethisphere Institute, February 2024 (also 2015–2023); for more information about the ‘World’s Most Ethical Company’ designation and scoring methodology, please visit www.worldsmostethicalcompanies.com.

Digital financial services benchmarking firm Keynova Group ranked U.S. Bank #1 for mobile banking apps in its Q3 2023 Mobile Banker Scorecard.

All regular account opening procedures apply. $25 minimum deposit required to open a U.S. Bank consumer checking account. Members of the military (requires self-disclosure) and clients ages 24 and under and those 65 and over pay no monthly maintenance fee.

Safe Debit Account is subject to certain account limitations and eligibility requirements, including the use of bill pay and Mobile Check Deposit. Please refer to the U.S. Bank Safe Debit Account Terms and Conditions (PDF) and Safe Debit Account Pricing and Information (PDF) guide for details. Refer to Your Deposit Account Agreement (PDF) and the Consumer Pricing Information (PDF) disclosure for a summary of fees, terms and conditions that apply.